Trainings

Business Office Training Request

Travel Training - Presented June 2025

- Topics Covered:

- Approvers

- Advances

- Conference Fees

- Vehicle Usage Hierarchy

- Personal Car vs. Rental Car

- OGS Trip Calculator

- Per Diems

- Lodging

- Over-the-Max Lodging Request

- Travel Reimbursement

- Tips

- Non-Employee Travel Reimbursements

- Travel Toolbox

Business Office Operations Overview

Checklists

Travel Reimbursement

Employee Travel

☐ Travel Authorization Form – To be completed at least 2 weeks prior to departure.

- Travel Advances

- Allowed for Meals, Lodging, and/or Airfare (but not less than $75 total) and must be indicated on Travel Authorization

- Meals & Lodging – advance paid 2 weeks before departure

- Airfare – advance paid 4 weeks before departure

- Advances that exceed the actual travel reimbursement must be refunded and a check made payable to “SUNY Cortland” within 30 days of return.

- Allowed for Meals, Lodging, and/or Airfare (but not less than $75 total) and must be indicated on Travel Authorization

- Who needs to sign?

☐ Traveler

☐ Traveler’s Supervisor

☐ Dean's AA or VP

☐ If traveling outside of NYS or international, Provost will need to sign (for Academic Affairs).

☐ Conference Registration Fees

- If registration fees can be prepaid, Dept. AA should prepay this with their p-card.

- If registration fees cannot be prepaid, then traveler will pay when they arrive.

☐ Modes of Transportation

- ☐ Airline

- ☐ Car Rental (State Contract)

- Enterprise – Contact Travel Administrator at travel@cortland.edu or x2306 for direct billing account #.

- Hertz – Contact Travel Administrator at travel@cortland.edu or x2306 to make the reservation for you.

- Rental FAQs

- ☐ Personal Vehicle

- ☐ Must complete an OGS Trip Calculator

- Traveler will be reimbursed the lesser of the cost of a rental car or driving their own personal vehicle according to OGS Trip Calculator.

- ☐ Must complete an OGS Trip Calculator

- ☐ Meals

☐ Day Trip

-

-

- Leave at or before 7:00 AM, entitled to breakfast (see website for current rates)

- Return at or after 7:00 PM. entitled to dinner (see website for current rates)

-

-

-

- ☐ Method I (Un-Receipted Method) (uncommon)

- Staying with friends/family

- See Travel Rates Method 1 table for current rates

- Staying with friends/family

- ☐ Method II (Receipted Method) (most common)

- Use GSA listed rates based on destination location (City, State or Zip) and then by month of travel.

- Receipt(s) required for lodging

- No receipt(s) required for meals

- Meal per diem is for dinner the 1st night and breakfast the following day (unless leaving at or before 7:00 AM on the 1st day or returning at or after 7:00 PM on last day)

- Use GSA listed rates based on destination location (City, State or Zip) and then by month of travel.

- ☐ Method I (Un-Receipted Method) (uncommon)

-

- ☐ Lodging

- If hotel of choice is over the lodging per diem listed, must complete the Over-the-Max Lodging Request Form (e-form)

- Do NOT book hotel until OTM is fully signed.

- Tax Exempt (in-state lodging) – Print and give to traveler to sign and give to hotel at check-in.

- If hotel of choice is over the lodging per diem listed, must complete the Over-the-Max Lodging Request Form (e-form)

- Per Diem Calculator

☐ Travel Voucher – To be completed within 30 days of returning from trip

- Areas to complete on Travel Voucher:

Top portion – Traveler & Trip Information

Do NOT add SSN

-

-

- Payee Name (first & last)

- Address (Street, City, State Zip)

- Destination Address (Street, City, State Zip)

- Date & Time of Departure (include AM or PM)

- Date & Time of Return (include AM or PM)

- Official Work Station (if you work at the SUNY Cortland Campus)

- Yes = “SUNY Cortland”

- No = “Home”

- If unsure, contact the Business Office.

-

Section 1 – All Travel Expenses

-

-

- Lodging

- Transportation Expense

- Misc Expenses

- Parking

- Tolls – after trip, be sure to print out your E-ZPass statement showing the charges by date or include receipt(s) with voucher

- Gas – must have receipt

- Conference Registration

- Meals – use Per Diem Calculator for assistance

- Mileage

- Must include Statement of Automobile Travel (AC160)

- Total up Travel Expenses

-

Section 2 – Summary

-

-

- A = Total from Section 1

- B = Subtract any amounts from Section 1 that were paid with a p-card/travel/NET card (ex. Conference Registration Fees paid by Dept AA)

- C = Subtract amount paid with Travel Advance

- D = Specify if any other adjustments were made (i.e. partial payment against another voucher)

- Total amount to be reimbursed

-

Payee’s Certification

-

-

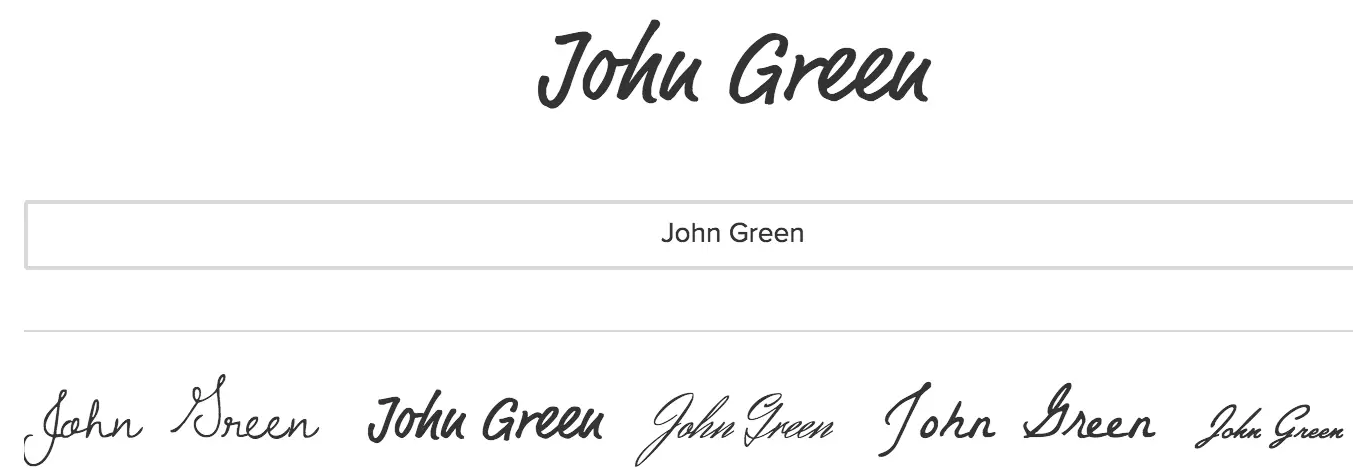

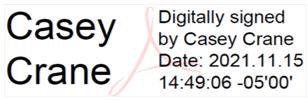

- Traveler signs (no digital or e-signature allowed)

- Enter email

- Date

-

Supervisor’s Certification

-

-

- Traveler’s Supervisor signs (no digital or e-signature allowed)

- Print name & title

- Date

-

Account #

-

-

- add account # to charge

-

☐ Receipts & Backup

- ☐ Scan all receipts & backup and combine into (1) PDF with travel voucher on top.

- Meal receipts not needed when using per diem rates.

- ☐ Email fully signed Travel Voucher & backup to Travel Administrator at travel@cortland.edu.

Travel Voucher cannot be digitally or e-signed (see Signature Types).

Printable Checklist (check back for updated versions)

Non-Employee Travel

Job Candidates

☐ Transportation

- Airline

- Car Rental

- Mileage

- Uber/Lyft/Taxi Service

☐ Lodging

- To be booked locally by Dept. AA (or Provost’s Staff Associate if using Provost’s account) and billed directly to campus.

- AA to submit as a PO via RDD.

☐ Meals

- Itemized receipts must be included for meals on their own.

- Meal per diems do NOT apply to non-employees.

- Alcohol will not be reimbursed.

☐ Candidate’s Interview Agenda/Itinerary

- Include copy with backup

- Areas to complete on Standard Voucher:

Top portion – Payee Information

Do NOT add SSN

-

-

- Payee Name (first & last)

- Email Address

- Address (Street, City, State Zip)

- (where the check will be mailed to)

-

Middle Section – Description of Material/Service

-

-

- Dates and itemized listing of expenses (i.e. airfare, rental car, mileage, meals)

- Per Diem Rates do NOT apply to non-employees.

- Itemized receipts required (without, they will not be reimbursed for that meal)

- Total Travel Expenses

- Net = Grand Total to be reimbursed

- Dates and itemized listing of expenses (i.e. airfare, rental car, mileage, meals)

-

Payee Certification

-

-

- Job Candidate signs (no digital or e-signature allowed)

- Date

-

Supervisor’s Certification

-

-

- Dept Chair signs (no digital or e-signature allowed)

- Title

- Date

-

Cost Center Unit

-

-

- Add account # to charge

-

☐ Receipts & Backup

- ☐ Scan all receipts & backup and combine into (1) PDF with Standard Voucher on top.

- ☐ Email fully signed Standard Voucher and backup to accounts.payable@cortland.edu.

Standard Voucher cannot be digitally or e-signed (see Signature Types).

Printable Checklist (check back for updated versions)

Student Travel (when employed by university (i.e., Graduate Assistants))

☐ Travel Authorization Form – To be completed at least 2 weeks prior to departure.

- Who needs to sign?

☐ Traveler

☐ Traveler’s Supervisor

☐ Dean or VP

☐ If traveling outside of NYS or international, Provost will need to sign.

☐ Meals

- Itemized receipts must be included for meals.

- Meal per diems do NOT apply to students.

- Alcohol will not be reimbursed.

- Areas to complete on Standard Voucher:

Top portion – Payee Information

Do NOT add SSN

-

-

- Payee Name (first & last)

- Email Address

- Address (Street, City, State Zip) (where the check will be mailed to)

-

Middle Section – Description of Material/Service

-

-

- Dates and itemized listing of expenses (i.e. airfare, rental car, mileage, lodging, meals)

- Meal per diems do NOT apply to students.

- Itemized receipts required (without, they will not be reimbursed for that meal)

- Total Travel Expenses

- Net = Grand Total to be reimbursed

- Dates and itemized listing of expenses (i.e. airfare, rental car, mileage, lodging, meals)

-

Payee Certification

-

-

- Student signs (no digital or e-signature allowed)

- Date

-

Supervisor’s Certification

-

-

- Dept Chair signs (no digital or e-signature allowed)

- Title

- Date

-

Cost Center Unit

-

-

- Add account # to charge

-

Receipts & Backup

- ☐ Scan all receipts & backup and combine into (1) PDF with Standard Voucher.

-

- ☐ Email fully signed Standard Voucher and backup to accounts.payable@cortland.edu.

Standard Voucher cannot be digitally or e-signed (see Signature Types).

Printable Checklist (check back for updated versions)

Enterprise Rental

☐ Determine Employee vs. Non-Employee Status for Renting Off State Contract

- If State employee, continue with checklist.

- If RF employee, student, on leave, or other non-employee, do not continue with checklist (as a rental is not permitted using SUNY Cortland’s account).

- If unsure, check here: https://www2.cortland.edu/offices/purchasing-office/travel-guidelines/#car-rentals.

☐ Call Travel Administrator at ext. 2306

☐ Request campus account number and billing number (for direct billing).

-

- Travelers should not be providing their personal credit cards at time of rental.

☐ Complete Travel Authorization for traveler

- Must be fully approved and filed with Travel Administrator prior to trip.

☐ Reserving a Vehicle

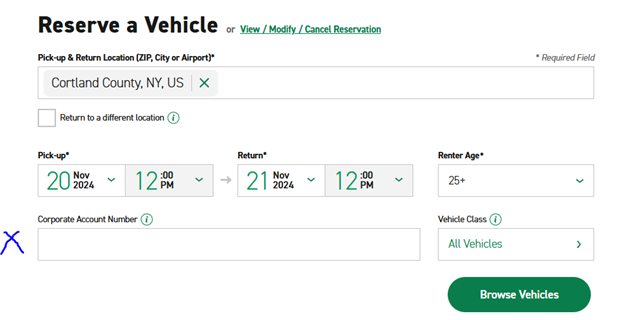

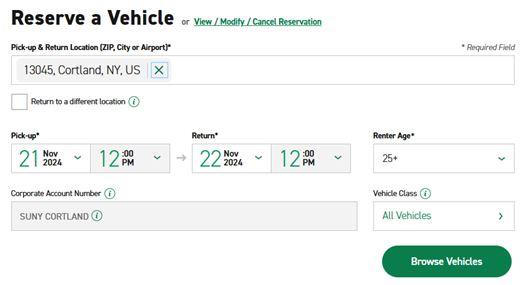

☐ Link to Enterprise online renting for government employees

-

- Enter account # (provided by Travel Administrator) under “Corporate Account Number” (shown below).

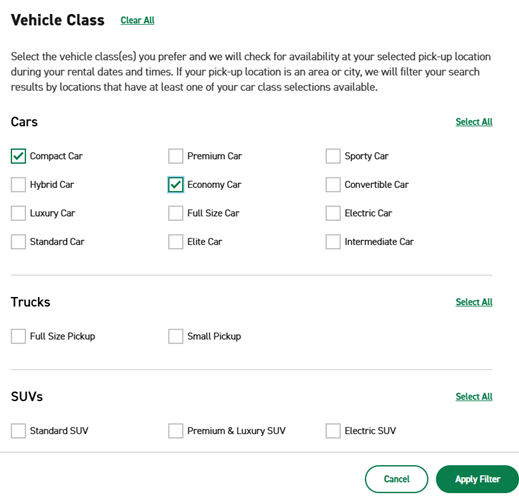

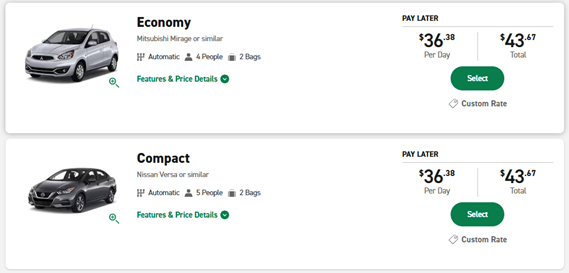

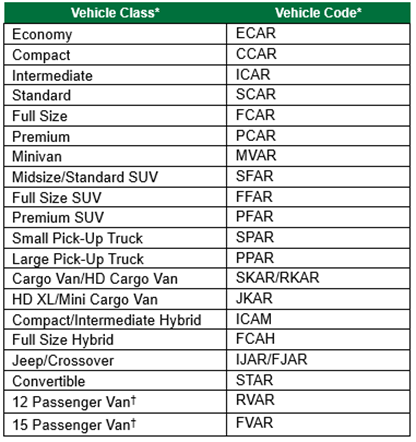

☐ Select Vehicle Class to filter by size

-

- Choose Economy/Compact size

- If Standard/Intermediate/Full-size are selected, written justification must be provided with invoice/PO.

- Any size larger than Standard/Intermediate/Full-size requires prior approval by Travel Administrator and that written approval must be provided with invoice/PO.

- Failure to obtain prior approval will result in the traveler paying the difference of the larger vehicle out of their own pocket.

☐ Click “Apply Filter”

☐ Click “Browse Vehicles”

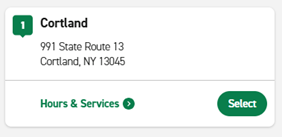

☐ Choose a Location and click “Select”

☐ Click “Select” on vehicle of choice

☐ Extras

-

- Do NOT add any extras (i.e. Sirius XM, Greenhouse Gas Emissions Offset, Insurance, etc.)

☐ Click “Continue to Review”

☐ Review & Reserve

-

- Contact Details

☐ Enter Traveler’s Contact Details (first & last name, phone #, & email)

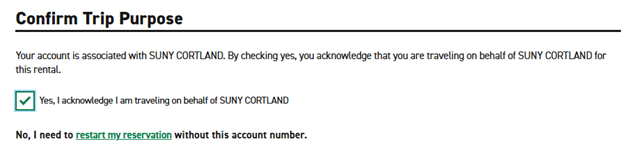

☐ Confirm Trip Purpose (check box to acknowledge travel is on behalf of the university)

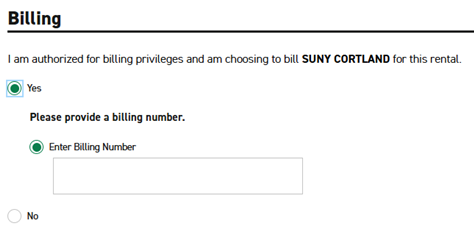

☐ Billing

☐ Select “Yes” for direct billing

☐ Enter Billing Number (provided by Travel Administrator)

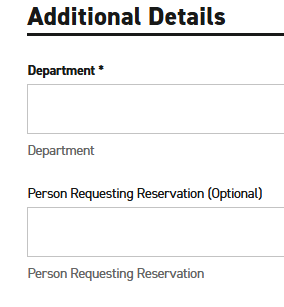

☐ Additional Details

☐ Enter Department (of Traveler)

☐ Enter the name of the person requesting the reservation (if different than the traveler)

☐ Save Time At The Counter (Optional)

-

- This sectional is optional if the traveler is completing the reservation and would like to provide their Driver’s License information at this time.

- Otherwise, select “No”.

☐ Click “Reserve Now”

-

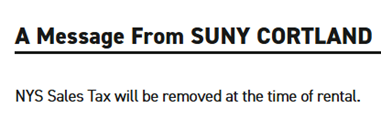

- Note: At the top of the screen, the following message will appear stating that NYS Sales tax will be removed at the time of rental.

Reasons to book online vs. calling local office:

- Automatic tax exemption online

- Emailed confirmation of rental

- Department and contact information ensured to appear on billing statement for invoice(s)

☐ Upon Returning from Trip

☐ Accounts Payable will email invoice(s) to Dept. AA based on dept. & contact information on billing statement from Enterprise.

-

- Dept. AA will:

☐ Review invoice to ensure there is no tax and everything is correct.

☐ Create a PO in RDD and attach invoice (1 invoice/PO, per NOR Policy) and, if applicable, justification for any vehicle size larger than Compact/Economy or approval from Travel Administrator for any size larger than Standard/Intermediate/Full-size.

☐ Upon final approval of PO, go back into PO and receive & close the PO.

-

-

-

- This allows AP to pay the invoice.

-

-

-

- For those departments/offices with a standing Enterprise PO for the fiscal year, once you receive the invoice from AP, go into RDD and receive that amount against your standing PO.

- Dept. AA will:

☐ Reply to AP with receiving completed against RDD PO, and, if applicable, attach justification to the email for any vehicle size larger than Compact/Economy or approval from Travel Administrator for any size larger than Standard/Intermediate/Full-size.

Vehicle codes on invoice (to know if you need justification for a larger vehicle than Economy/Compact):

Printable Checklist (check back for updated versions)

External Program Class Reviewer Payment

☐ Evidence of Terms of Agreement

- Must clearly state how much they will get paid for their services and specify the services (prior to supplying goods/services).

- Email is acceptable

☐ Invoice

- Vendor must provide an invoice (department can provide a template, but department should not fill out the invoice themselves).

☐ Mileage

- Allowed roundtrip mileage at current GSA rate

☐ W-9

- Payee is required to submit their W-9, as this is a taxable service

☐ NYS Employee

- If Payee is/has been a NYS employee within the last two (2) years, do not proceed with this checklist and payment will be processed via Human Resources/Payroll.

- Must submit Form #10 to sarah.vanliew@cortland.edu.

- If reimbursing mileage, for NYS employee, that may be included on a Standard Voucher (see step below) and no W-9 is required for this.

- Meals are not reimbursable.

- Areas to complete on Standard Voucher:

Top portion – Payee Information

-

-

- Payee Name (first & last)

- Email Address

- Address (Street, City, State Zip)

- (where the check will be mailed to)

-

Middle Section – Description of Material/Service

-

-

- Date(s) and goods/services provided

- Total

- Net = Grand Total to be paid

-

Payee Certification

-

-

- Payee signs (no e-signature allowed)

- Date

-

Supervisor’s Certification

-

-

- Dept Chair signs (no e-signature allowed)

- Title

- Date

-

Cost Center Unit

-

-

- Add account # to charge

-

Receipts & Backup

- ☐ Scan all receipts & backup and combine into (1) PDF with Standard Voucher.

-

- ☐ Email fully signed Standard Voucher and backup to accounts.payable@cortland.edu.

Standard Voucher cannot be digitally or e-signed (see Signature Types).

Printable Checklist (check back for updated versions)

Student/Peer Notetaker Payment

☐ Evidence of Terms of Agreement

- Must clearly state how much they will get paid for their services and specify the services (prior to supplying goods/services).

- Email is acceptable

☐ Invoice

- Vendor must provide an invoice (Department can provide a template, but Department should not fill out the invoice themselves.)

☐ W-9

- Payee is required to submit their W-9, as this is a taxable service

- Areas to complete on Standard Voucher:

Top portion – Payee Information

-

-

- Payee Name (first & last)

- Email Address

- Address (Street, City, State Zip)

- (where the check will be mailed to)

-

Middle Section – Description of Material/Service

-

-

- Date(s) and goods/services provided

- Total

- Net = Grand Total to be paid

-

Payee Certification

-

-

- Payee signs (no e-signature allowed)

- Date

-

Supervisor’s Certification

-

-

- Director of Disability Resources Office signs (no digital or e-signature allowed)

- Title

- Date

-

Cost Center Unit

-

-

- Add Dept/Office account # to charge

-

☐ Voucher & Backup Documentation

- ☐ Scan voucher & backup and combine into (1) PDF with Standard Voucher.

- ☐ Email fully signed Standard Voucher and backup to accounts.payable@cortland.edu.

Standard Voucher cannot be digitally or e-signed (see Signature Types).

Printable Checklist (check back for updated versions)

Athletic Officials Payment

☐ Evidence of Terms of Agreement

- Must clearly state how much they will get paid for their services (prior to supplying the services), if not currently listed on Athletic Official Fee Schedule (housed by Purchasing & Accounts Payable).

- Email is acceptable

☐ W-9

- Payee is required to submit their W-9, as this is a taxable service

- Areas to complete on Standard Voucher:

Top portion – Payee Information

-

-

- Payee Name (first & last)

- Email Address

- Address (Street, City, State Zip)

- (where the check will be mailed to)

-

Middle Section – Description of Material/Service

-

-

- Date(s) and goods/services provided

- Total

- Net = Grand Total to be paid

-

Payee Certification

-

-

- Payee signs (no e-signature allowed)

- Date

-

Supervisor’s Certification

-

-

- Dept Chair signs (no e-signature allowed)

- Title

- Date

-

Cost Center Unit

-

-

- Add account # to charge

-

☐ Receipts & Backup

- ☐ Scan voucher & backup and combine into (1) PDF with Standard Voucher.

- ☐ Email fully signed Standard Voucher and backup to accounts.payable@cortland.edu.

Standard Voucher cannot be digitally or e-signed (see Signature Types).

Printable Checklist (check back for updated versions)

Vendor Payments Paid Via Standard Voucher (Taxable)

Use instructions below for vendors that use their Social Security Number (SSN) and not an Employer Identification Number (EIN).

(For vendors using EIN’s, send vendor’s W-9 to Purchasing & Accounts Payable to be added to Red Dragon Depot (RDD).)

☐ Evidence of Terms of Agreement

- Must clearly state how much they will get paid for their goods/services (prior to supplying goods/services).

- Email is acceptable

☐ Invoice

- Vendor must provide an invoice (Department can provide a template, but Department should not fill out the invoice themselves).

***If over $2,500, Reasonableness of Price Checklist is required per purchasing guidelines.***

☐ W-9

- Payee is required to submit their W-9, as this is a taxable service

☐ Flyer

- If this was a campus event, include a copy of the flyer or email that went out to campus/group.

☐ Attendance Sheet

- If this was a campus event where attendance was taken, include a copy of the attendance sheet.

- Areas to complete on Standard Voucher:

Top portion – Payee Information

-

-

- Payee Name (first & last)

- Email Address

- Address (Street, City, State Zip)

- (where the check will be mailed to)

-

Middle Section – Description of Material/Service

-

-

- Date(s) and goods/services provided

- Total

- Net = Grand Total to be paid

-

Payee Certification

-

-

- Payee signs (no e-signature allowed)

- Date

-

Supervisor’s Certification

-

-

- Dept Chair/Director/Dean/VP signs (no e-signature allowed)

- Title

- Date

-

Cost Center Unit

-

-

- Add account # to charge

-

☐ Receipts & Backup

- ☐ Scan voucher & backup and combine into (1) PDF with Standard Voucher.

- ☐ Email fully signed Standard Voucher and backup to accounts.payable@cortland.edu.

Standard Voucher cannot be digitally or e-signed (see Signature Types).

Printable Checklist (check back for updated versions)

Speaker/Campus Guest Payment

☐ Evidence of Terms of Agreement

- Speaker Service Agreement

- ☐ Completed by Department and then sent to be signed and notarized by Speaker/Agency representative prior to event/performance.

- ☐ Send to Purchasing Assistant for authorized signature prior to event/performance.

☐ W-9

- Payee is required to submit their W-9, as this is a taxable service

☐ Insurance

- Proof of Workers’ Compensation (Form C-105.2)

- Certificate of Exemption (CE-200)

☐ Lodging

- To be booked locally by Department Administrative Assistant (or Provost’s Staff Associate, if using Provost’s account), if included in Speaker Service Agreement.

- Department AA will then submit invoice via RDD.

☐ Meals

- Itemized receipts must be included for meals on their own, if included in Speaker Service Agreement.

- Meal per diems do NOT apply to non-employees

- Alcohol will not be reimbursed.

☐ Flyer

- Include a copy of the flyer or email that went out to campus/group.

☐ Invoice

- Vendor must provide an invoice (Department can provide a template, but Department should not fill out the invoice themselves).

- An acceptable invoice contains:

- Invoice #

- Invoice Date

- Vendor Name & Address

- To: SUNY Cortland, PO Box 2000, Cortland, NY 13045

- Description of Goods/Services Requesting Payment for

- Date(s) of Service

- Amount Requested

- An acceptable invoice contains:

***If over $2,500, Reasonableness of Price Checklist is required per purchasing guidelines.***

☐ Payment

- For speaker/campus guest using an Employer Identification Number (EIN) and not their Security Number (SSN), should be entered as a PO in RDD.

- Send vendor’s W-9 to Purchasing & Accounts Payable to be added to Red Dragon Depot (RDD) via New Vendor Request Form.

- Create PO in RDD and include any backup documentation (including fully executed speaker agreement).

- Upon receipt of invoice, send directly to accounts.payable@cortland.edu.

- Do not proceed with the rest of this checklist.

- For speaker/campus guest using their Social Security Number (SSN), complete Standard Voucher.

- ☐ Standard Voucher

- Areas to complete on Standard Voucher:

- ☐ Standard Voucher

Top portion – Payee Information

Do NOT add SSN

-

-

-

- Payee Name (first & last)

- Email Address

- Address (Street, City, State Zip)

- (where the check will be mailed to)

-

-

Middle Section – Description of Material/Service

-

-

-

- Dates and itemized listing of expenses (i.e. airfare, rental car, mileage, meals)

- Per Diem Rates do NOT apply to non-employees.

- Itemized receipts required

- Total Travel Expenses

- Net = Grand Total to be paid

- Dates and itemized listing of expenses (i.e. airfare, rental car, mileage, meals)

-

-

Payee Certification

-

-

-

- Speaker/Campus Guest signs (no digital or e-signature allowed)

- Date

-

-

Supervisor’s Certification

-

-

-

- Dept Chair/Director/Dean/VP signs (no digital or e-signature allowed)

- Title

- Date

-

-

Cost Center Unit

-

-

-

- Add account # to charge

-

-

☐ Receipts & Backup

- ☐ Scan all receipts, backup and signed agreement and combine into (1) PDF with Standard Voucher.

- ☐Email fully signed Standard Voucher and backup to accounts.payable@cortland.edu.

Standard Voucher cannot be digitally or e-signed (see Signature Types).

Printable Checklist (check back for updated versions)

Signature Types

Allowable

- Original, Scanned Signature

Example

Non-Allowable

- Typed Signature

Example

- Digital Signature

Example

How-to Guides & Videos

- Buyer's Guide

- Intended for Administrative Assistants (access to RDD)

- Change Order Request Form How-to Video

- P-Card How-to Videos:

- Travel Guides

- Approval Hierarchies

- Form Filler Approval Guide (for Travel Authorization)

- Travel How-to Videos: